- 04 Sep 2024

- 5 min read

- By Claire Ryan

No stopping Queensland's hot property

Queensland’s property market is continuing its impressive run with median sales prices steadily creeping up, according to the latest data released by the Real Estate Institute of Queensland (REIQ).

The quarterly median sales results for the June 2024 Quarter demonstrate the Sunshine State continues to go from strength to strength in property price performance.

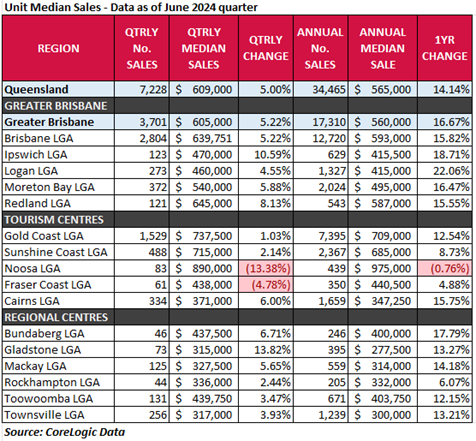

The statewide median house price climbed 4.46 per cent over the quarter, and an impressive 12.14 per cent over the year. Not to be outdone, Queensland’s median unit price rose five per cent over the quarter, and 14.14 per cent annually.

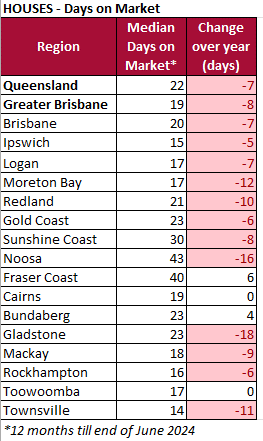

The market also quickened its pace, with the median number of days on market tightening by about a week compared to the year prior. Queensland’s houses are now selling in about 22 days, while units are being snapped up in just 19 days.

Among the strongest quarterly growth in the state in the house market, were regional areas such as Rockhampton (9.2%), Townsville (8.34%), Gladstone (6.74%) and Mackay (6.19%).

Taking a longer-term view and looking at annual house growth however, the top four performers were Ipswich (16.67%), Brisbane (16.16%), Toowoomba (16.02%) and Rockhampton (15.07%).

For the unit market, quarterly price growth stood out in Gladstone (13.82%) and Ipswich (10.59%), while the annual growth was staggering in Logan (22.06%) and again Ipswich (18.71%) showing a surge for the suburbs on the cusp of the capital city.

REIQ CEO Antonia Mercorella said there was excitement in the air for Brisbane and beyond.

“Brisbane has so much going for it at the moment with various transformational projects in the works for entertainment, infrastructure and transport,” Ms Mercorella said.

“The Star’s launch against the stunning backdrop of Riverfire on the weekend was certainly a postcard perfect moment, showcasing a city that’s becoming impossible to outshine.

“There’s a growing buzz around Brisbane and it seems everyone is catching on to the incredible lifestyle on offer here.

“The optimism for our capital city is contagious, creating a ripple effect right across the state – great news for all Queenslanders.”

Ms Mercorella said while both metropolitan and regional areas in Queensland experienced robust price growth, she highlighted the challenges first home buyers face in Queensland - namely a widening deposit gap.

“In Queensland, a 20% home deposit for a first home now represents 1.64 times the average annual earnings,” she said.

“With the annual median house price in Brisbane now $1.15m, the median deposit is now $200,000, putting the dream of home ownership out of reach for many.

“High rental costs make it incredibly difficult for individuals to save for a home purchase, and when you also factor in the additional costs of stamp duty, potential lender’s mortgage insurance, and other buying costs, the prospect of owning a home can seem impossible for first home buyers.

“The REIQ has proposed several measures to the Queensland Government to help homebuyers overcome this significant deposit gap in our recently launched state election policy platform.”

She added that the recent CBA Annual Results presentation highlighted that cost-of-living challenges are hitting younger cohorts the hardest.

“The data shows that all age brackets from 20 to 44 are seeing a deterioration in their savings by at least three per cent,” Ms Mercorella said.

“As the REIQ demonstrated in our state election policies, it is this demographic that we need to help into home ownership, as they are facing the most difficult economic environment in living memory.”

Notes to Editors:

-

Insights derived by the Real Estate Institute of Queensland based on CoreLogic Data.

-

A median sale price is derived by arranging a set of sale prices from lowest to highest and the selecting the middle value within this set (i.e. the 50th percentile, where half of recorded sales were less and half were higher than the median).

-

Only suburbs and regions to record sufficient sales numbers (at least 10 sales for the quarter) at the time of reporting are considered statistically significant.

-

Days on market is calculated as the median number of days it has taken to sell properties (from first advertised date to contract date) by private treaty during the last 12 months (excludes auction listings and listings where an asking price is not advertised).

ENDS

Media enquiries:

Claire Ryan, Media and Stakeholder Relations Manager, The Real Estate Institute of Queensland

M: 0417 623 723 E: media@reiq.com.au

HOUSE DATA

HOUSE MARKET HIGHLIGHTS

The highest volume of house sales across the quarter were Brisbane (3,072), Gold Coast (1,790) and Moreton Bay (1,622).

The statewide median house price increased by 4.46% over the quarter, bringing the median price to $773,000. Annually, the median price rose by an impressive 12.14%.

Brisbane, Gold Coast, Sunshine Coast and Noosa remain our state’s million-dollar median markets with our capital city and beaches arguably the jewels in the crown of Queensland.

Most regions across Queensland experienced robust growth in both quarterly and annual median house prices, reflecting the ongoing strength of the state's property market.

Brisbane LGA & Ipswich LGA: These areas within Greater Brisbane exhibited some of the strongest annual growth, highlighting their appeal to buyers and investors.

Tourism Centres: The Gold Coast and Sunshine Coast continue to perform well, though Noosa showed a quarterly blip, which could indicate market fluctuations or a cooling in buyer demand in that specific area.

Regional Centres: Townsville, Rockhampton, and Toowoomba showed particularly strong growth, suggesting a rising demand in these regional markets, possibly driven by affordability compared to metropolitan areas.

The longest annual median days on market were Noosa (43 days), Fraser Coast (40), and Sunshine Coast (30). The fastest were Townsville (14), Ipswich (15) and Rockhampton (16).

UNITS DATA

UNIT MARKET HIGHLIGHTS

Queensland’s median unit price saw a quarterly increase of 5%, bringing the median price to $609,000 – hot on the heels of the housing market.

The unit market remains highly competitive, appealing to both investors and homebuyers alike, with significant annual growth rates in most markets across Queensland. Over the past year, the median price for units rose by a robust 14.14%, underscoring the strong demand for this property type.

Greater Brisbane continues to showcase its strength with areas like Ipswich and Logan leading the charge in annual growth.

Tourism Centres such as the Gold Coast and Sunshine Coast sustained steady growth, cementing their status as key markets for unit sales. While Noosa experienced a notable quarterly decline, and Fraser Coast had a small dip, both these markets had a relatively small volume of sales over the quarter, and annual figures are therefore more reliable.

In the Regional Centres, Bundaberg, Mackay, Gladstone and Townsville demonstrated impressive annual growth, signalling rising demand and the potential for continued expansion in these regions.

The longest lengths of time to contract for unit sales over the past 12 months were seen in Noosa (51.5 days) and Townsville (36). On the other end of the spectrum, Greater Brisbane units were moving in just two weeks (14 days).

DAYS ON MARKET

Read another media release from the REIQ: Razor thin vacancy rates keep Queenslanders living on the edge.

Or browse our suite of media releases.

You may also like

View All Articles

View All Articles

Start your Real Estate Career

Need help? 1300 697 347 or contact us